Get in touch

Please contact us to discuss how working with Myriad can maximise and secure R&D funding opportunities for your business.

Contact usCompare SME & RDEC R&D tax schemes to maximise your claim. Learn eligibility, rates & key differences for these schemes.

With all the discussion around HMRC’s updates to the R&D tax schemes, it can be tricky to find information for those who still need to use the old schemes.

Important note: Though they’re being replaced with the Merged Scheme for all companies with accounting periods beginning on or after 1 April 2024, the SME and RDEC schemes are still relevant for any company claiming for a period beginning before then.

Knowing which of the schemes you need to claim through is your responsibility and has a direct impact on your tax benefit, meaning you could be leaving money on the table by not getting it right. More importantly, you could open yourself to a compliance check from HMRC if you don’t make a correct claim.

If your accounting period begins before 1 April 2024, you’ll need to claim through one of the below schemes, which have different requirements, rates and rules.

The SME Scheme is the longest-running R&D tax credit scheme in the UK and receives the most claims every year, in both number and value. With nearly 90% of claims made through the SME Scheme in 2022/23, it’s a good thing it has higher rates of relief and an expanded set of eligible costs compared to the RDEC Scheme.

It has historically had the highest rate of relief and is more generous with the expenditure categories that can be claimed. It can be claimed as tax relief (i.e., as a reduction on a company’s corporation tax bill), or surrendered as a payable cash credit for loss-making companies. The claim is made in a different way to the RDEC scheme, resulting in an additional deduction on your tax return rather than an expenditure credit.

The rates of the SME Scheme changed for expenditure incurred on or after 1 April 2023, reducing the benefit that SMEs could receive.

Loss-making, R&D-intensive SMEs can claim through the more favourable Enhanced R&D Intensive Support (ERIS) Scheme, which is available for expenditure incurred from 1 April 2023.

To qualify as an SME, a company must:

Companies that exceed these conditions must claim through the RDEC Scheme. Read more about the impact of company size on a claim.

Loss-making R&D-intensive SMEs can claim a higher rate of relief through the ERIS Scheme.

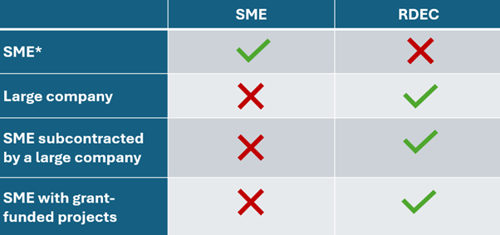

SMEs with subsidised projects (e.g., contracted out by another company or grant-funded projects) cannot claim through the SME Scheme due to rules against claiming for subsidised projects. In some cases, these SMEs can claim through the RDEC Scheme.

Making a claim through the SME Scheme means that companies can:

The rate that you can claim depends on when the expenditure occurred. The rates decreased for expenditure incurred from 1 April 2023. If your accounting period straddles this date, you’ll need to create two notional periods and use the different rates on the relevant period.

Expenditure up to 31 March 2023

This results in a real-world benefit of 24.7% for profit-making companies and 33.35% for loss-making companies.

Expenditure from 1 April 2023

This results in a real-world benefit of 21.5% for profit-making companies and 18.6% for loss-making companies.

Companies can claim all of the expected cost categories: staff costs, contractors, externally provided workers, consumable items, software licenses, cloud computing costs, data licenses and clinical trial volunteer payments.

The R&D Expenditure Credit (RDEC) Scheme was split out from the SME Scheme to better suit the projects of larger companies. However, the RDEC Scheme has slightly different cost categories which reduce the total R&D expenditure that can be claimed compared to the SME Scheme. Your tax benefit is also received in a different way

Like the SME scheme, the rates for claiming changed for expenditure beginning on 1 April 2023, increasing the benefit to large companies (but still below the benefit given to SMEs).

To calculate the expenditure credit, claimants multiply the total qualifying R&D expenditure by the relevant expenditure credit rate and then include this figure in their taxable profits.

For expenditure incurred from 1 April 2023, companies claiming through the RDEC Scheme can claim an increased rate, giving these companies a greater benefit for their R&D work:

If your accounting period straddles this date, you’ll need to create two notional periods and use the different rates on the relevant period.

Large companies (i.e., those exceeding the SME thresholds discussed above) can claim the R&D expenditure credit.

Additionally, SMEs contracted to do R&D for a large company can claim for this expenditure through the RDEC Scheme. This only applies to SMEs contracted by large companies; SMEs contracted by other SMEs cannot claim for those projects, per the rules of subsidised expenditure.

The RDEC Scheme doesn’t allow claimants to include most subcontracted costs. Therefore, an SME contracted by a large company can claim for this expenditure through the RDEC Scheme, as there is no risk of the large company claiming for the same work.

Similarly, SMEs with grant-funded projects can claim through the RDEC Scheme. This only applies to grants that are state aid. Projects funded by state aid cannot be claimed through the SME Scheme, as the SME Scheme is also considered state aid. However, it can be claimed through the RDEC Scheme.

The main cost categories are available through the RDEC scheme, including staff costs, externally provided workers, consumable items, software licenses, cloud computing costs, data licenses and clinical trial volunteer payments.

The main difference, as explained above, is that companies claiming through the RDEC Scheme cannot claim for any subcontracted costs unless the work is is undertaken by:

*So long as the SME does not meet either of the RDEC scheme requirements.

Some SMEs may find that portions of their claim are made through the RDEC scheme and others through the SME scheme. For example, an SME with two projects would usually claim both through the SME scheme. However, if one of those projects was grant-funded, the costs incurred on that project would need to go through the RDEC scheme, whilst the other project could remain on the higher rate of relief.

With both the SME and RDEC schemes, there are now additional requirements for some companies looking to make a claim.

First-time claimants and those who have not made a claim in the last three years need to submit an Advance Notification Form to HMRC to let them know that the company intends to make a claim. This form only needs basic project information, far less than what's required in the actual R&D tax credit claim, however it is essential to making a valid claim.

The deadline to submit this form is six months after the end of the accounting period; knowing whether this rule applies to you can be tricky to work out but has drastic consequences if you get it wrong!

Try our Advance Notification Form Checker now and take the guesswork out of compliance.

Still not sure what scheme your claim belongs under, or if your claim is eligible at all? Our R&D tax eBook should answer all your questions, from qualifying projects to how to submit your claim.

Alternatively, get in touch with our experts for a free review of your claim’s eligibility.

Theatre, Orchestra and Museums & Galleries tax reliefs changed from April 2025. Find out what the new rates mean for your organisation.

UKRI is restructuring £8bn in research funding. Learn what's changing, what stays the same, and how to secure R&D funding for your business.

Discover concrete examples of R&D tax credit qualifying projects across IT, manufacturing, and pharmaceuticals. Learn to identify eligible activities in your business.

Please contact us to discuss how working with Myriad can maximise and secure R&D funding opportunities for your business.

Contact us